As we look to the future, the trend of cognitive automation in insurance points towards an increasingly intelligent and automated industry. Insurers who adopt these technologies early and integrate them deeply into their operations are set to lead the market, offering superior services while managing costs and complexities more effectively.

Automation Trends in the Insurance Sector

As the insurance industry continues to evolve, cognitive automation emerges as a transformative force, reshaping how insurers operate and serve their customers. This integration of cognitive automation in insurance is not just a trend—it's becoming a cornerstone of modern insurance practices. By leveraging advanced AI and machine learning, insurers are able to automate complex processes, enhance decision-making, and provide more personalized customer experiences.

The application of cognitive automation in the insurance sector is seeing a rapid expansion in several key areas. From claims processing to underwriting and customer service, the technology is enabling faster, more accurate operations. Cognitive tools analyze and process vast amounts of data, including unstructured data like text and images, making them invaluable in detecting fraud, assessing risks, and customizing policy offerings.

Furthermore, cognitive automation is playing a pivotal role in improving customer interactions. Through chatbots and virtual assistants that understand and process natural language, insurers are offering 24/7 customer support, streamlining claim registrations, and providing real-time updates. This level of interaction not only enhances customer satisfaction but also optimizes workflow efficiency, allowing human employees to focus on more complex and strategic tasks.

What Is Cognitive Automation?

Cognitive automation represents the cutting edge of artificial intelligence applications in the insurance industry, combining AI with sophisticated cognitive technologies to mimic human tasks in complex environments. This advanced form of automation integrates machine learning, natural language processing, and data analysis to enhance and automate decision-making processes within the insurance sector.

At its core, cognitive automation extends beyond simple rule-based automation to encompass systems that can learn and adapt over time. This capability allows for the handling of unstructured data such as text, emails, and documents, which are prevalent in insurance claims and policy processing. By automating these cognitive tasks, insurers can achieve greater efficiency, accuracy, and speed in their operations.

The impact of cognitive automation in insurance is profound, facilitating quicker claims processing, more accurate risk assessment, and personalized customer service. It enables insurers to deliver faster, more responsive service, which is crucial in an industry where customer satisfaction and trust are paramount. For insurance companies, the adoption of cognitive automation technologies is not just about technological advancement but also about staying competitive in a rapidly evolving marketplace.

Overview of Cognitive Automation in Insurance

Cognitive automation is revolutionizing the insurance industry by enhancing how companies process data, interact with customers, and manage claims. This innovative technology, a cornerstone of digital transformation in insurance, leverages artificial intelligence (AI) to perform tasks that typically require human intelligence. The adoption of cognitive automation in insurance is not just a trend; it's a strategic move towards more efficient and customer-focused operations.

In this overview, we explore how cognitive automation integrates into various facets of the insurance business. From automating the underwriting process to transforming customer service interactions, cognitive tools offer a range of solutions that help insurance companies reduce errors, cut costs, and speed up service delivery. These tools are designed to handle large volumes of complex and unstructured data—such as text, images, and real-time interactions—which are integral to insurance operations.

Describe your idea and get an estimation for your AI project

Contact UsMoreover, cognitive automation helps insurers enhance their decision-making processes. By utilizing predictive analytics and machine learning models, insurers can better assess risks, set premiums, and even prevent fraud. This technology's ability to learn and improve from patterns and outcomes makes it invaluable in adapting to new challenges and expectations in the insurance landscape.

For insurance companies looking to thrive in today's digital era, integrating cognitive automation into their operations is crucial. It not only boosts operational efficiency but also improves customer satisfaction by providing quicker and more accurate services. As we delve deeper into the capabilities and benefits of cognitive automation, it's clear that this technology is shaping the future of insurance.

How Cognitive Automation is Used in the Insurance Sector

Cognitive automation is transforming the insurance sector by introducing smarter, faster, and more accurate ways of handling operations traditionally managed by human employees. As insurers adopt cognitive automation, they leverage its capabilities to enhance every aspect of their business—from client interactions to backend processing. This section explores the practical applications of cognitive automation in insurance, highlighting its impact on the industry.

One of the primary uses of cognitive automation in insurance is in claims processing. By employing AI-driven systems, insurance companies can automate the evaluation of claims, rapidly gathering and analyzing data to determine claim validity. This reduces processing times and helps eliminate human errors, leading to quicker claim resolutions and increased customer satisfaction.

Another significant application is in underwriting. Cognitive automation tools analyze vast amounts of data, including past claims and customer interactions, to assess risks more accurately. This enables insurers to offer more tailored policies and pricing, thereby enhancing their competitive edge in the market.

Customer service is also greatly enhanced through cognitive automation. AI-powered chatbots and virtual assistants can handle a wide range of customer queries, from policy details to claim status updates, providing 24/7 service that is both efficient and cost-effective.

Furthermore, cognitive automation supports fraud detection by identifying patterns and anomalies that might indicate fraudulent activity. With advanced analytics and machine learning, these systems can flag suspicious cases for further investigation, thus safeguarding against losses.

Incorporating cognitive automation into their operations allows insurance companies to not only improve efficiency but also provide better, more personalized services, making it a key strategy for growth in the modern insurance landscape.

Benefits of Cognitive Automation in Insurance

Cognitive automation is reshaping the insurance sector by delivering a multitude of benefits that drive efficiency, enhance accuracy, and improve customer satisfaction. This powerful technology leverages artificial intelligence (AI) to mimic human cognitive functions, transforming the way insurance companies operate. Here, we explore the key advantages of integrating cognitive automation in insurance, illustrating its impact on the industry's landscape.

Increased Efficiency: By automating routine and complex tasks, cognitive automation significantly speeds up insurance processes such as claims handling, policy administration, and underwriting. This not only reduces the workload on human employees but also decreases the turnaround time for customer service requests, leading to a more efficient operational model.

Enhanced Accuracy: Cognitive automation systems utilize machine learning and data analytics to process and analyze large volumes of information with a high degree of accuracy. In the insurance industry, this translates to fewer errors in claims processing and risk assessment, ensuring more reliable outcomes and minimizing the risk of costly mistakes.

Improved Customer Experience: Automation tools equipped with natural language processing can interact with customers in real-time, providing responses and support without human intervention. This capability ensures that customer inquiries are handled promptly, which is crucial for enhancing customer satisfaction and loyalty.

Cost Reduction: By automating tasks that traditionally require manual intervention, insurers can reduce labor costs and allocate resources more effectively. Cognitive automation also helps in reducing operational costs by streamlining processes and minimizing the likelihood of error-related expenses.

Advanced Analytics for Decision Making: Cognitive automation provides insurers with advanced analytical tools that help in better decision-making. By predicting trends, assessing risks, and generating insights from vast datasets, insurers can make informed decisions that align with their business strategies and market demands.

Fraud Detection and Prevention: With its ability to analyze patterns and recognize anomalies, cognitive automation plays a critical role in identifying and preventing fraudulent activities. This not only protects revenue but also safeguards the insurer’s reputation.

The adoption of cognitive automation in insurance is proving to be a strategic enabler for innovation and competitive advantage. As more insurance companies recognize these benefits, cognitive automation is set to become a standard practice, pivotal to transforming operations and achieving business success.

Use Case: Cognitive Automation In Insurance

We at Businessware Technologies are professionals at building AI-powered systems for improving document-heavy processes. We have created dozens of cognitive automation systems for a variety of industries, including document automation applications for the insurance industry.

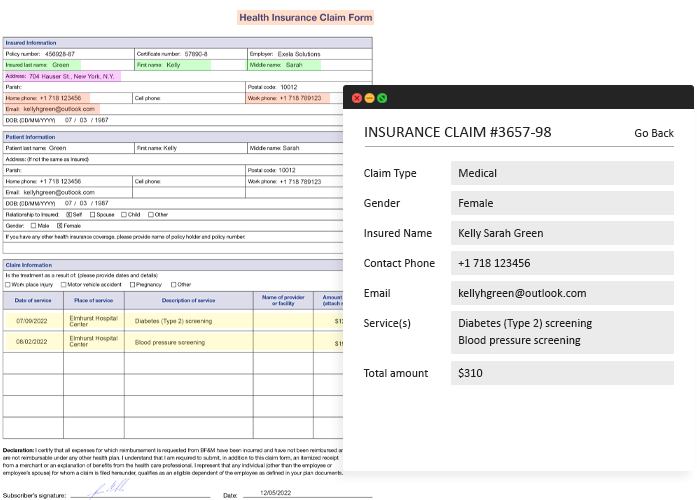

Processing Insurance Claims With AI

Insurance claim handling is a process which has already been digitized and automated quite extensively. There are multiple tools and solutions for processing insurance claims, both digital and paper claims. However, given the high variety of claim layouts and their complex nature, traditional OCR methods of document digitization can only go so far.

AI is better suited for processing complex documents, which is why our client, a startup in the intelligent document processing field, came to us to develop an AI-powered system for automation data extraction from insurance claims.

We have created an AI-powered data extraction system for insurance claims that detects document structure and extracts relevant data in a matter of minutes. The module extracts data from the claims and prepares it for further processing.

Looking for a development team?

Send us details of your project and we will get back with a time and price estimation

We have designed the system to work efficiently under high load conditions to accommodate for the increase of users when our client turns it into a SaaS solution for other companies.

- Claim Type Detection: The system detects claim type (medical, business, etc.) and its layout to improve data extraction and its accuracy. It extracts claim type and title, automating the document identification and digitization efforts.

- Processing Of Multiple Template Types: The system can work with various claim templates and designs, allowing for seamless data extraction from different claim types. It can detect input fields and determine their type, like free-form text boxes, time and date fields, and more, as well as extract the data from the fields.

- Input Field Detection: Insurance claims have many different data field types, all of which look different from each other and present relevant data differently, for example, in a form of plain text, a checkbox, date and time, etc. The system can detect multiple input field types, and extract data accordingly, for instance, it can detect checkboxes to determine which of the multiple options was marked.

- Detection Of Tables And Table Cells: The system we have developed can analyze tables of any complexity, detect table cells, extract table titles and its content into an Excel file for further editing.

How to Implement Cognitive Automation in Insurance

Implementing cognitive automation within the insurance sector involves a strategic and structured approach. By integrating cognitive technologies, insurance companies can enhance their operational efficiency and customer service. Here's a step-by-step guide on how to successfully implement cognitive automation in insurance, ensuring alignment with industry best practices and optimization of returns on investment.

Assess Areas for Automation: The first crucial step is to conduct a thorough assessment of potential areas within your insurance operations where automation can be most beneficial. This involves identifying processes that are repetitive, prone to human error, or significantly time-consuming. Common areas in insurance include claims processing, customer service interactions, and policy management.

Define the Business Case: For each identified area, develop a clear business case that outlines the anticipated benefits, such as cost reduction, efficiency gains, error reduction, or improved customer satisfaction. A strong business case supports investment decisions and sets the foundation for project prioritization and resource allocation.

Decide On Automation Form: Cognitive automation encompasses various technologies, including robotic process automation (RPA), machine learning, and natural language processing. Deciding on the form of automation involves choosing the appropriate technology that matches the complexity of the tasks and the goals of automation. This decision should consider the technical feasibility and the potential impact on the business.

Select Your Development Partners: The selection of development partners is pivotal. Choose partners who not only bring technical expertise in AI and automation but also have a deep understanding of the insurance industry. Effective collaboration with experienced vendors can drive the project’s success, from planning through to implementation and scaling.

Approve the Automation Roadmap: Lastly, formal approval of a comprehensive automation roadmap is essential. This roadmap should detail the project phases, timelines, expected milestones, and key performance indicators. It should also include strategies for change management, training, and scaling the automation solutions across the organization.

Following these steps can significantly streamline the implementation of cognitive automation in insurance, ensuring that insurers can reap the maximum benefits of this powerful technology. This structured approach not only improves operational efficiencies but also enhances the overall customer experience, positioning insurance companies as leaders in a competitive digital landscape.

Why choose Businessware Technologies as your software development company?

- Businessware Technologies is a reliable AI development vendor: it has been recognised as one of the top software development companies by Clutch and Manifest, it is a Top Rated Plus agency Upwork, and has received local awards for its excellent work,

- A team of over 70 highly skilled software engineers with extensive experience in developing complex software for both startups and Fortune 500 companies,

- Deep expertise in modern AI technologies and approaches to system development, like data science, machine learning, OpenCV, Python, Tesseract, and many more,

- Businessware Technologies is a Microsoft Gold Certified partner,

- Businessware Technologies is compliant with GDPR, ISO 9001, ISO 27001 standards,

- Businessware Technologies works with Fortune 500 companies and has had decades-long relationships with most of its clients,

- Businessware Technologies has proven to be a reliable AI outsourcing partner by having an excellent track record in AI and ML development backed by an extensive portfolio of successful projects.