The global insurance industry processes over $1 trillion in claims annually, yet traditional methods of handling these claims are often plagued by inefficiencies, delays, and rising operational costs. From manual data entry to lengthy verification processes, the current system struggles to keep up with the growing demand for faster, more accurate claim resolutions. For customers, this often translates to frustrating wait times and a lack of transparency, while insurers face the dual challenges of reducing costs and combating fraud.

Enter Artificial Intelligence (AI)—a game-changing technology that is revolutionizing how insurance claims are processed. By leveraging AI-powered tools like machine learning, natural language processing (NLP), and computer vision, insurers can automate repetitive tasks, detect fraudulent activities, and deliver faster, more accurate claim settlements. The result? A win-win for both insurers and policyholders: reduced costs, improved efficiency, and a seamless customer experience.

Looking for AI developers?

We create AI software — and we do it well. Talk to us to get your project started today

In this article, we’ll explore how AI insurance claims are transforming the industry, the benefits of automating claim processing, and what the future holds for this innovative technology. Whether you’re an insurer looking to streamline operations or a policyholder curious about how AI can improve your experience, read on to discover how AI is reshaping the world of insurance claims.

The Current State of Insurance Claim Processing

Insurance claim processing has long been a cornerstone of the insurance industry, but it’s also one of its most cumbersome and resource-intensive tasks. Traditionally, the process involves multiple steps, each requiring significant manual effort and time. Here’s a breakdown of how it typically works:

- Claim Submission: Policyholders submit claims through forms, emails, or calls, often accompanied by supporting documents like photos, medical records, or police reports.

- Data Entry and Verification: Insurers manually input data from these documents into their systems, cross-checking for accuracy and completeness.

- Assessment and Investigation: Claims adjusters review the details, assess damages, and sometimes conduct on-site inspections or interviews to validate the claim.

- Approval or Denial: Based on the findings, the claim is either approved for payment or denied, often after lengthy deliberation.

- Payout: If approved, the payment is processed, which can take additional time depending on the complexity of the claim.

While this process has been the standard for decades, it’s far from perfect. Some of the most pressing challenges include:

- Time-Consuming Processes: Manual data entry and verification can take days or even weeks, leading to delays in claim resolution.

- High Operational Costs: The need for human adjusters and extensive paperwork drives up costs for insurers.

- Human Error: Manual processes are prone to mistakes, whether in data entry, calculations, or judgment calls.

- Fraud Risks: Detecting fraudulent claims is difficult without advanced tools, costing the industry billions annually.

- Customer Dissatisfaction: Lengthy processing times and lack of transparency often leave policyholders frustrated.

These inefficiencies highlight the urgent need for a better approach—one that leverages technology to streamline operations, reduce costs, and improve customer satisfaction. This is where AI in insurance claims comes into play, offering a transformative solution to these long-standing challenges.

By automating repetitive tasks, enhancing accuracy, and enabling real-time fraud detection, AI is poised to redefine how insurance claims are processed. In the next section, we’ll dive deeper into how this technology is making waves in the industry.

How AI is Transforming Insurance Claim Processing

Artificial Intelligence (AI) is no longer a futuristic concept—it’s a practical, powerful tool that’s already reshaping the insurance industry. By leveraging advanced technologies like machine learning (ML), natural language processing (NLP), and computer vision, insurers are now able to automate and optimize the claims process like never before. Here’s how AI is making a significant impact:

1. Automated Data Extraction and Processing

One of the most time-consuming aspects of claim processing is manually extracting and inputting data from documents like claim forms, medical records, and police reports. AI-powered tools can automatically scan, read, and extract relevant information from these documents with remarkable accuracy. For example:

- NLP can analyze unstructured text from emails or handwritten notes.

- Optical Character Recognition (OCR) can digitize printed or handwritten documents.

This not only speeds up the process but also reduces the risk of human error.

2. Fraud Detection and Prevention

Insurance fraud is a massive problem, costing the industry an estimated $40 billion annually in the U.S. alone. AI excels at identifying patterns and anomalies that may indicate fraudulent activity. By analyzing historical data and real-time inputs, AI algorithms can:

- Flag suspicious claims for further investigation.

- Detect unusual patterns, such as multiple claims for the same incident.

- Predict high-risk claims based on behavioral data.

This proactive approach helps insurers save money while maintaining trust with honest policyholders.

3. Damage Assessment with Computer Vision

Assessing damage—whether it’s a car accident, property damage, or a natural disaster—often requires an adjuster to visit the site. AI-powered computer vision can analyze photos or videos submitted by policyholders to assess damage automatically. For instance:

- In auto insurance, AI can evaluate vehicle damage and estimate repair costs.

- In property insurance, it can assess structural damage from storms or fires.

This not only speeds up the process but also reduces the need for in-person inspections.

4. Intelligent Chatbots for Customer Support

AI-driven chatbots are revolutionizing customer service in the insurance industry. These virtual assistants can:

- Answer policyholder questions about the claims process.

- Provide real-time updates on claim status.

- Guide customers through the submission process.

By handling routine inquiries, chatbots free up human agents to focus on more complex tasks, improving efficiency and customer satisfaction.

5. Predictive Analytics for Faster Decision-Making

AI doesn’t just react to claims—it can predict them. By analyzing historical data and external factors (e.g., weather patterns, economic trends), AI can:

- Predict the likelihood of claims being filed.

- Identify high-risk policyholders or regions.

- Help insurers allocate resources more effectively.

This forward-looking approach enables insurers to be proactive rather than reactive.

AI For Insurance Claim Automation: Case Studies

We at Businessware Technologies hve extensive experience in creating AI systems for processing insurance and healthcare related documents: Here are two examples of how AI can be used to automate the processing of these documents on a large scale:

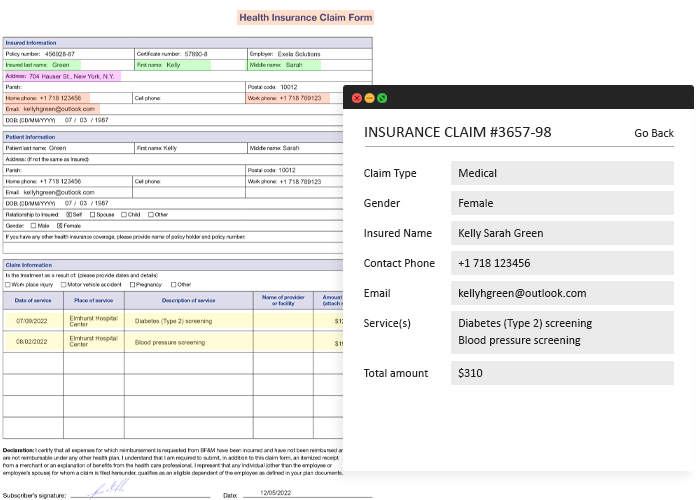

Robotic Process Automation System For Insurance Claims

Our client. a startup in the intelligent document processing field, approached us to develop an AI data extraction module capable of automatically detecting insurance claim type and layout, extracting typed and handwritten text.

The system had the following requirements:

- Processing of high variety of claim templates and designs as the layout and design of an insurance claim can look different depending on the claim type (medical insurance, business insurance, life insurance, etc.) and type of client (individuals, businesses, corporations),

- Extracting data from complex tables,

- High processing speed and high efficiency: the claim processing system is a SaaS solution for large insurance companies, meaning high document count and thousands of users daily.

Using AI To Extract Data From Insurance Claims

We have created an AI-powered data extraction module for insurance claims that detects document structure and extracts relevant data in a matter of minutes. The module extracts data from the claims and prepares it for further processing.

- Detection Of Claim Type: The module detects claim type (medical, business, etc.) and its layout to improve data extraction and its accuracy. It extracts claim type and title, automating the document identification and digitization efforts.

- Processing Of Multiple Template Types: The AI module can work with various claim templates and designs, allowing for seamless data extraction from different claim types. The system can detect input fields and determine their type, like free-form text boxes, time and date fields, and more, as well as extract the data from the fields.

- Input Field Detection: The AI module can detect multiple input field types, and extract data accordingly, for instance, it can detect checkboxes to determine which of the multiple options was marked.

- Detection Of Tables And Table Cells: The module we have developed can analyze tables of any complexity, detect table cells, extract table titles and its content into an Excel file for further editing.

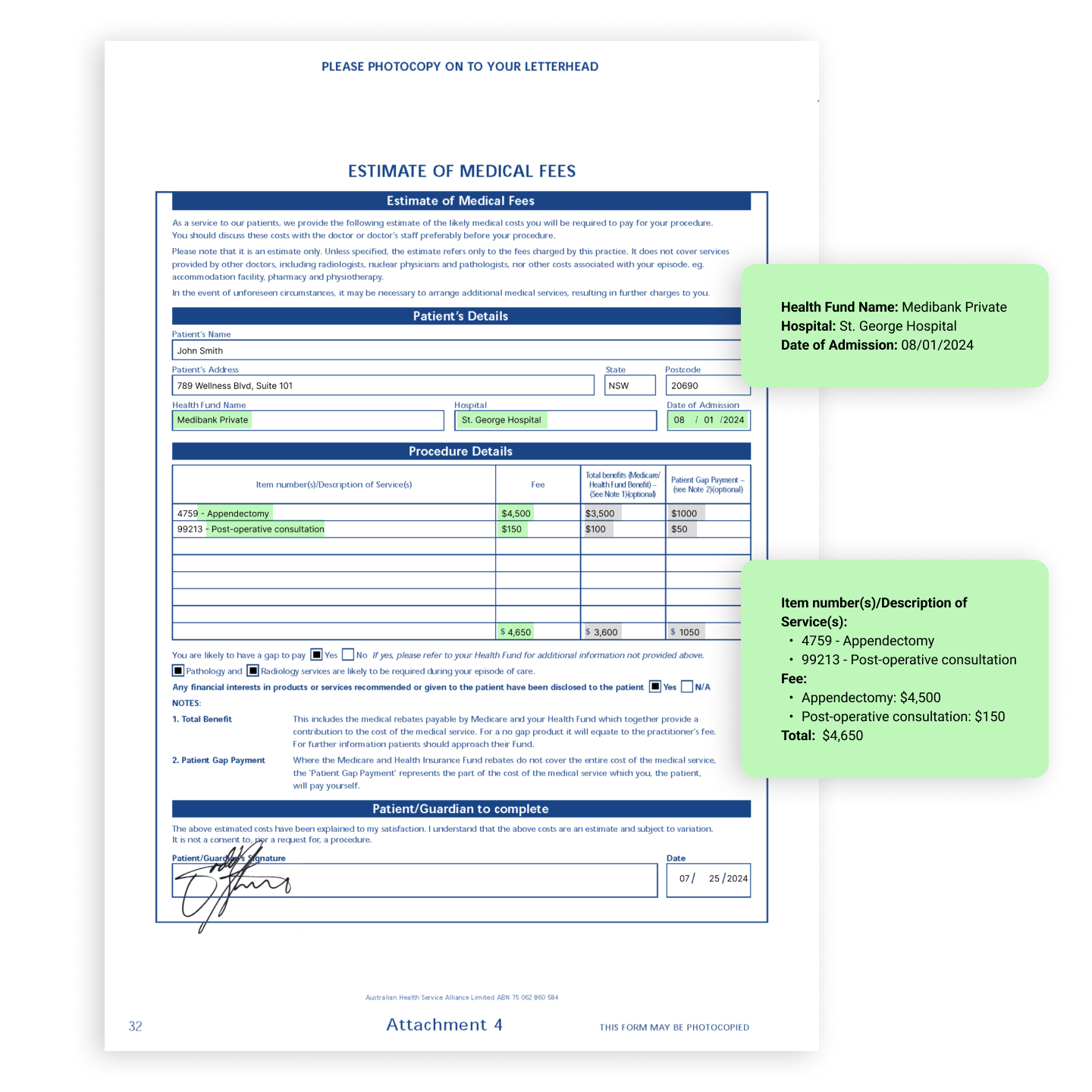

Electronic Health Record Document Processing System

Our client, a startup in the field of eHealth, has approached us to create a system for processing medical records with the goal of extracting relevant data, like patient data, treatment and cost.

Medical records are complex documents with variable layouts and terminology, unstructured data like doctors notes and handwritten text, so this project requires deep expertise in modern computer vision algorithms and large language models to develop an effective tool for smart health record processing.

LLMs For Analysing Medical Documents

We have created an AI-powered medical records processing app capable of extracting data from multi page documents irrespective of their layout and format.

Our app extracts only prespecified data, ignoring non-essential information like patient instructions and nurses notes, and navigates the difference in terminology used between hospitals to ensure data uniformity.

- Multiple Layout Processing: Since each hospital uses their own medical record format, it was important for our client that the system could process various document layouts. We have implemented an algorithm that detects key elements on each page, like patient contact data part or treatment cost part, and extracts data given the nuances of the layout at hand.

- Variable Terminology: Our machine learning team has implemented multiple LLMs to combat the issue of variable terminology across different hospitals and treat different words describing the same subject as one and the same. Using the power of modern language models, our app "understands" the meaning behind terms used in the documents and groups items by meaning, rather than specific words used to describe them.

- Relevant Data Retrieval: We have developed a document crawling module that uses powerful computer vision and OCR algorithms to quickly detect and isolate blocks of text with relevant information even if data is spread across multiple pages. The app is capable of dividing one large file into multiple health records and extracting data from each one, ignoring non-essential information, like ECG, images, and patient instructions.

Benefits of Automating Insurance Claims with AI

The adoption of AI in insurance claim processing isn’t just a technological upgrade—it’s a strategic move that delivers measurable benefits for both insurers and policyholders. By automating repetitive tasks, enhancing accuracy, and enabling faster decision-making, AI is transforming the claims process into a more efficient, cost-effective, and customer-friendly experience. Here are the key benefits of using AI for insurance claims:

The integration of AI into insurance claim processing is transforming the industry, delivering significant benefits for both insurers and policyholders. By automating tasks, improving accuracy, and speeding up decisions, AI is making the claims process more efficient, cost-effective, and customer-friendly. Here are the key advantages:

Faster Claim Processing

AI slashes claim processing times from days or weeks to hours or even minutes. Tools like automated data extraction and computer vision for damage assessment eliminate manual steps, while chatbots provide real-time updates. This speed boosts customer satisfaction and allows insurers to resolve claims faster.

Reduced Operational Costs

AI cuts costs by automating repetitive tasks like data entry and document verification, reducing the need for human labor. Fraud detection algorithms also save money by identifying suspicious claims early, and predictive analytics help allocate resources more efficiently.

Improved Accuracy and Consistency

AI minimizes human error by ensuring precise data extraction, validation, and analysis. Machine learning applies rules consistently, and tools like computer vision provide accurate damage assessments. This accuracy builds trust between insurers and policyholders.

Enhanced Customer Experience

AI meets modern customer expectations with 24/7 chatbot support, real-time claim updates, and simplified submission processes. Faster resolutions and payouts lead to higher customer retention and loyalty.

Proactive Fraud Detection

AI combats fraud by analyzing historical data to spot suspicious patterns and flagging high-risk claims. Its ability to adapt to new fraud tactics helps insurers save millions annually.

Scalability and Flexibility

AI systems can handle growing claim volumes without losing speed or accuracy. They can also be tailored to different types of insurance, from auto to health, making them versatile tools for the industry.

Data-Driven Insights

AI generates valuable insights, such as predictive analytics for risk trends and customer behavior data for personalized services. These insights help insurers make smarter, data-driven decisions.

Challenges and Considerations of Implementing AI in Insurance Claims

While the benefits of AI in insurance claim processing are undeniable, implementing this technology is not without its challenges. Insurers must navigate a range of technical, ethical, and regulatory hurdles to fully realize the potential of AI. Here are the key challenges and considerations:

Data Privacy and Security

AI systems rely heavily on data, often including sensitive customer information such as medical records, financial details, and personal identifiers. Ensuring the privacy and security of this data is critical. Insurers must comply with regulations like the General Data Protection Regulation (GDPR) and implement robust cybersecurity measures to prevent data breaches. Failure to do so can result in legal penalties, financial losses, and damage to the company’s reputation.

Solution: Choose smaller, local AI models instead of larger ones like GPT. Use anonymized or synthetic data for AI training to minimize privacy risks.

High Implementation Costs

While AI can reduce operational costs in the long run, the initial investment can be significant. Developing or purchasing AI tools, integrating them into existing systems, and training staff require substantial resources. Smaller insurers, in particular, may struggle to afford these upfront costs, creating a potential gap between large and small players in the industry.

Solution: Start with pilot projects to test AI solutions on a smaller scale before full implementation.

Validate Your AI Idea

Talk to experienced AI developers to validate and test your idea

Regulatory Compliance

The insurance industry is heavily regulated, and AI systems must comply with these regulations. For example, AI algorithms used for claims processing must be transparent and free from bias to ensure fair treatment of policyholders. Insurers must also ensure that AI-driven decisions can be audited and explained, as regulators may require proof of compliance with industry standards.

Solution: Regularly review and update AI models to align with evolving regulations. Maintain detailed documentation of AI algorithms and decision-making processes for audits.

Ethical Concerns and Bias

AI systems are only as good as the data they are trained on. If the training data contains biases, the AI may produce unfair or discriminatory outcomes. For instance, an algorithm might unfairly deny claims from certain demographic groups if the data reflects historical biases. Insurers must actively monitor and address these issues to ensure ethical AI use.

Solution: Use diverse and representative datasets to train AI models.

Need for Human Oversight

While AI can automate many tasks, it is not a replacement for human judgment. Complex claims, exceptional cases, and customer disputes often require the nuance and empathy that only humans can provide. Insurers must strike a balance between automation and human involvement to maintain quality service and customer trust.

Solution: Implement a hybrid model where AI provides recommendations, but humans make final decisions. Train employees to work alongside AI tools, enhancing their decision-making capabilities.

Why choose Businessware Technologies as your software development company?

- Businessware Technologies is a reliable AI development vendor: it has been recognised as one of the top software development companies by Clutch and Manifest, it is a Top Rated Plus agency Upwork, and has received local awards for its excellent work,

- A team of over 70 highly skilled software engineers with extensive experience in developing complex software for both startups and Fortune 500 companies,

- Deep expertise in modern AI technologies and approaches to system development, like data science, machine learning, OpenCV, Python, Tesseract, and many more,

- Businessware Technologies is a Microsoft Gold Certified partner,

- Businessware Technologies is compliant with GDPR, ISO 9001, ISO 27001 standards,

- Businessware Technologies works with Fortune 500 companies and has had decades-long relationships with most of its clients,

- Businessware Technologies has proven to be a reliable AI outsourcing partner by having an excellent track record in AI and ML development backed by an extensive portfolio of successful projects.

If you have an AI project in mind and need help with implementation, contact our manager and they will be happy to help you.